At Biz Spheres, understanding the dynamics of successful investments is paramount. Exploring the concept of Return on Invested Capital (ROIC) is key. ROIC serves as the guiding metric to gauge the efficiency of capital utilization and value creation in investments.

What is ROIC?

Return on Invested Capital (ROIC) is a financial metric that measures a company’s efficiency in generating returns from the capital it has invested in its operations. It’s a crucial indicator of how effectively a company uses its capital to generate profits.

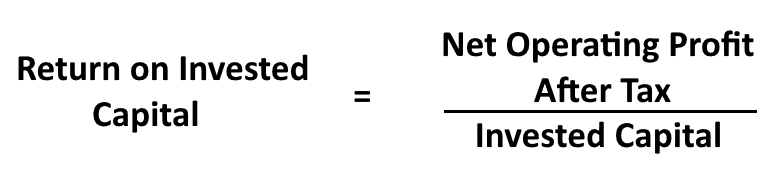

The formula for ROIC is:

- Net Operating Profit After Tax (NOPAT): This represents the operating profits of a company after accounting for taxes.

- Invested Capital: It includes both debt and equity financing, representing the total capital used to run the operations of the business.

ROIC is a significant metric for investors as it indicates how well a company utilizes the capital invested in it to generate profits. A higher ROIC typically implies more efficient use of capital, while a lower ROIC suggests inefficiency in generating profits relative to the capital employed. Comparing a company’s ROIC to its cost of capital helps assess whether it’s creating value for shareholders or not.

In essence, ROIC provides insight into a company’s ability to generate profits in relation to the total capital employed and is a valuable tool for assessing a company’s performance and the efficiency of its investments.

ROIC Insights: Understanding the Metric

Return on Invested Capital (ROIC) serves as a compass for investors. It assesses a company’s efficiency in generating returns from the capital invested, providing insights into the effectiveness of investment strategies.

This key financial metric takes into account both the profit generated and the capital employed, offering a comprehensive view of how effectively a company is using its resources to create value. Companies with a higher ROIC often signify better management of invested capital, translating to sustained profitability and long-term growth.

Calculating ROIC: Harnessing Profitability

ROIC, calculated by dividing net income by total invested capital and expressed as a percentage, unveils the efficiency of capital deployment. It’s a metric that determines if investments are creating or eroding value.

Understanding the nuances of this calculation is vital. It not only showcases the profitability of investments but also aids in comparing different companies within the same industry or sector. This enables investors to make informed choices regarding where to allocate their resources for optimal returns.

Value Creation with ROIC

ROIC acts as a decision-making tool. When the metric surpasses the cost of capital, it signifies value creation. Utilizing this insight empowers strategic investment choices and improved resource allocation.

Companies that consistently exhibit a higher ROIC compared to their cost of capital tend to outperform their counterparts. This is indicative of efficient capital employment, resulting in increased shareholder value and sustainable growth.

The Strategic Role of ROIC in Investment Decisions

The application of ROIC extends beyond assessing historical performance; it aids in future planning and decision-making. By forecasting and strategizing around potential changes in ROIC, investors and management can proactively steer towards value-enhancing actions.

Conclusion:

Return on Invested Capital isn’t just a metric; it’s a strategic guide for value creation within investments. Mastering the comprehension and application of ROIC empowers investors to steer towards maximum returns and sustainable value creation.